Mark W. Guthner is a veteran of the financial services industry. His skills and experience stretch across multiple disciplines including trading, portfolio and risk management, securities analysis and valuation, investment banking and financial technology.

Mark is currently an Associate Professor of Practice at Rutgers Business School where he teaches classes in Corporate Finance, Investment Analysis & Valuation, Investment Banking, Financial Modeling, Fixed income & Portfolio Theory. He also conducts academic research.

Mark served as a Principal, Portfolio Manager, Proprietary Trader and Equity Derivative Strategist at Banc of America Securities, CRT Capital Group LLC, and Dash Financial LLC. In these roles, Mark advised institutional investors on the use of options to express market views and to hedge or eliminate unwanted risks. In addition, he managed a proprietary trading book at BofA Securities, generating returns on equity of over 35%

Mark has significant international “in-country” experience. He held senior investment banking and risk management positions at Standard Chartered Bank and the Australian New Zealand Investment Banking Group. In these roles, he managed a $3.5 billion project finance loan portfolio and developed the group’s competitive and asset writing strategies. Furthermore, he served as a Senior Consultant with KPMG/Barents LLC where he developed the investment operations and trained the staff of Indonesia’s oldest and largest insurance company.

He began his career at Prudential Fixed Income Advisors and Hong Kong Shanghai Banking Corporation where he was a Senior Portfolio Manager and Bond Trader. In these roles, he managed and traded over $5 billion in fixed-income securities (both public and private placements, investment grade and high yield) for corporate pension, Taft-Hartley and financial institutions.

Mark is the author of 2 books.

(1) His first book, “Quantitative Analytics in Debt Valuation & Management” was published by McGraw-Hill in 2012. The book presents a breakthrough method for the analysis, pricing, and hedging of corporate debt obligations. It enables the arbitrageur to replicate corporate bonds using a combination of equity, equity options, and US Treasury Securities. In addition, it enables portfolio & risk managers to aggregate corporate bonds and equities into one common risk measure.

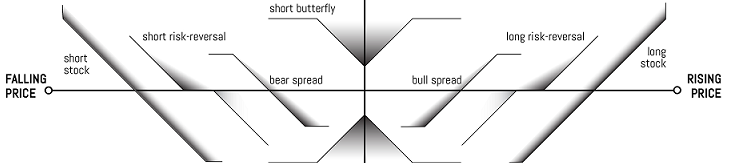

(2) His second book, "The Options Edge" was published by Wiley in 2016. It provides "An Intuitive Approach to Generating Consistent Profits for the Novice to the Experienced Practitioner." The book reveals unconventional methods for hedging and position trading based on a scientific study on the performance of Index options, that systemically improve investment outcomes.

Mark holds a BSE in Mechanical Engineering and an MBA in Finance from the University of Michigan, Stephen M. Ross School of Business. Finally, he volunteers his time and expertise in various capacities to the CFA Institute.